With mortgage lenders tightening their criteria and the need for a large deposit becoming ever increasingly necessary, Help to Buy could be the answer if you are struggling to raise a large enough deposit to get a mortgage and get on the housing ladder.

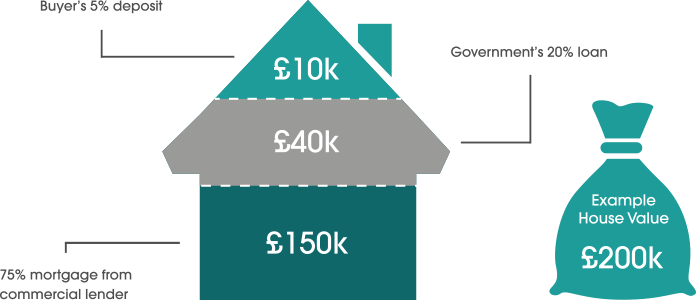

With the assistance of ”Help to Buy” you only need to raise 5% deposit and with the help of a 20% equity loan from the Homes and Communities Agency, you only then require a 75% mortgage. The good news is you pay nothing for the first 5 years on that 20% (after 5 years, the equity loan attracts 1.75% per annum, which will increase after year 5, each year by RPI (retail price index) +1%).

Help to Buy- is available to:

- First time buyers and home owners but you must not own any other property both in the UK or abroad

- 5% deposit required

- The purchase price of the new home on eligible developments cannot exceed £600,000

- 20% equity loan by HCA, paid back when the property is sold

- 75% mortgage required

- Interest charged on equity loan after 5 years

We would strongly recommend that you seek financial advice as to your suitability and eligibility of being able to use Help to Buy. Click below to start this process with one of our experts today!